New in 2023 R2 – Non-Numeric Payroll Input

As part of the 2023 R2 updates for payroll, Workday now supports non-numeric payroll inputs for new related calculations. This update allows earnings and deductions to have text, date, and/or Boolean (Yes/No) data factored into payroll calculations.

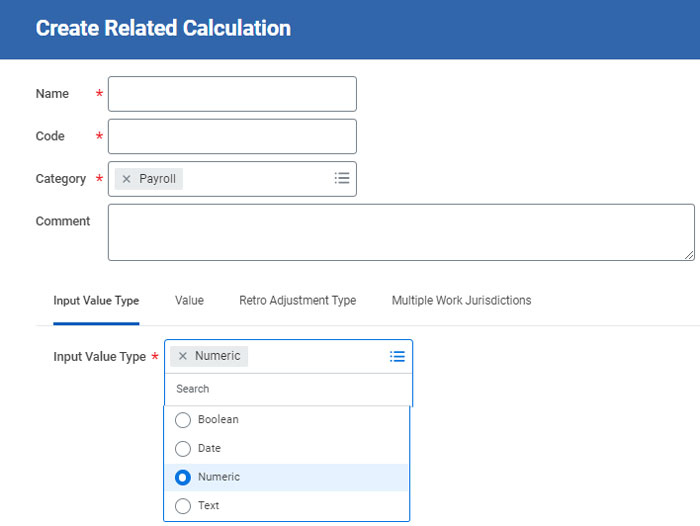

Input Value Type

The Create Related Calculation displays a new dropdown list, which tells Workday the type of data that can be configured as a Default Calculation or Override Calculation for that related calculation.

When the Input Value Type is Boolean, Workday supports the following calculation types from the calculation engine as the default and/or override calculation for the related calculation:

When the Input Value Type is Date, Workday supports the following calculation types from the calculation engine as the default and/or override calculation for the related calculation:

When the Input Value Type is Numeric, Workday supports the following calculation types from the calculation engine as the default and/or override calculation for the related calculation:

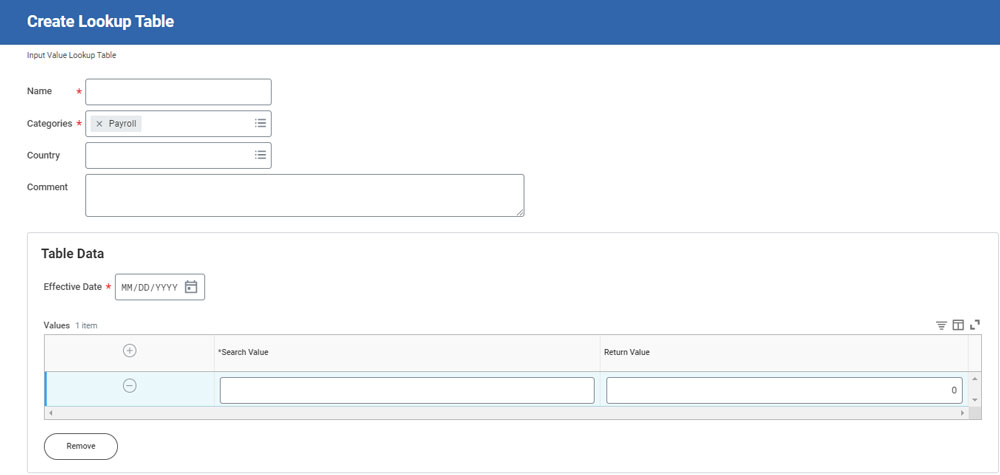

When the Input Value Type is Text, an input value lookup table is required for mapping fixed text values to numeric values.

Create Earning / Edit Earning / Create Deduction / Edit Deduction

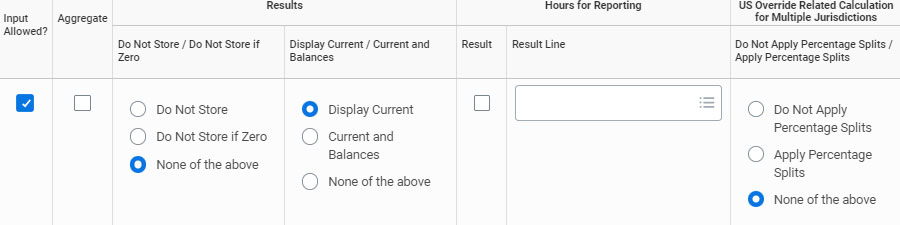

When adding a new non-numeric related calculation to the Effective Dated tab of an earning or deduction:

Additional Considerations

Pre-existing related calculations will automatically be converted to an Input Value type of Numeric.

You cannot change the input value type or input value lookup table of a related calculation once it has been saved to a pay component.

Non-Numeric input value types do not display on payroll results, payslips, and other reports, but they will be used to calculate pay component amounts as configured.

You cannot use non-numeric related calculations for FLSA earning amounts.

Input Value Lookup Table search and return values must be unique.

If a lookup table snapshot has been used in a payroll input:

When adding a new snapshot to an input value lookup table, update or end all ongoing and future-dated one-time payroll inputs affected by the new snapshot.