Navigating a Workday Financials Implementation

When you embark on the journey of deploying Workday Financials, the end goal is a transformative experience for your organization, allowing you greater automation, standardized process flows, and dynamic reporting.

However, roadblocks can occur throughout the journey that prevent your organization from harnessing the full power of Workday.

It is vital to approach the implementation process with careful planning and awareness to get the most out of your new ERP — both at go live and in the future.

Here are four crucial insights to consider before – or during – deploying Workday Financials:

1. Start with the End in Mind

Before getting hung up on the technicalities aspects, it is crucial to define the end goals and objectives.

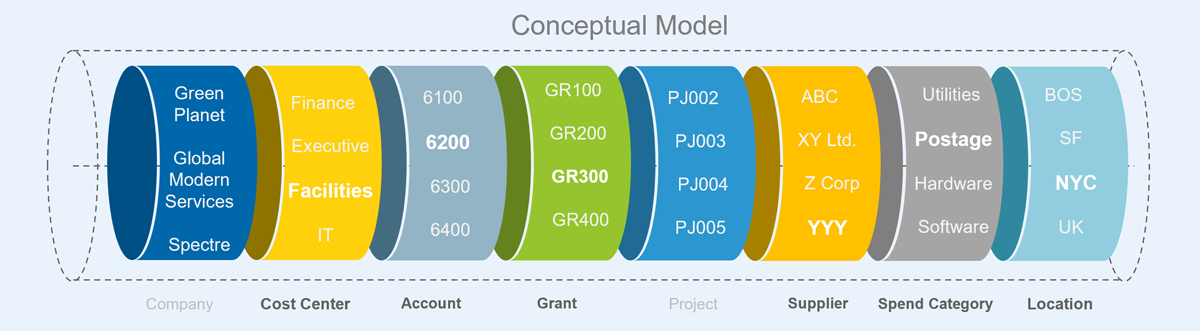

The starting point in your implementation will be the Foundation Data Model (FDM) sessions. The FDM sessions are like building the foundation to your home. They determine the organizational structure and chart of account design in Workday.

When preparing for FDM sessions:

2. Understanding Workday’s Operational Framework

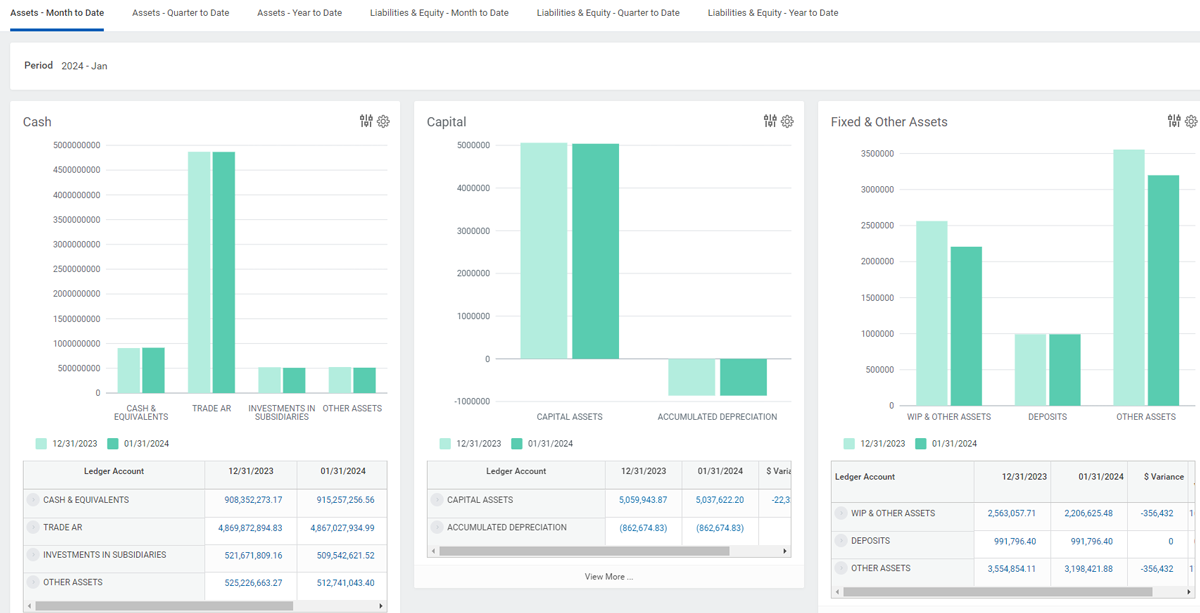

Workday differs from legacy ERP systems by leveraging worktags to drive postings on financial transactions to the general ledger.

Ledger Accounts vs. Worktags

Rather than end users selecting the ledger account for their transaction, they are instead selecting worktag values, such as spend category and cost center. The accounting rules engine, in Workday called the Account Posting Rule Set, is in the background mapping the worktags to the ledger account on the resulting journal line.

We recommend including end users early on in Workday design sessions. Having end-user feedback during design and testing will ensure they understand the worktag structure and how their selection will determine the accounting outcome.

Shifting user’s mindset away from a legacy account string to the word-based, worktag model takes time and practice in the system. Early understanding of how accounting is driven in Workday will ensure more meaningful testing and validation of accounting, as well as a smoother Day 1 experience as end users begin transacting.

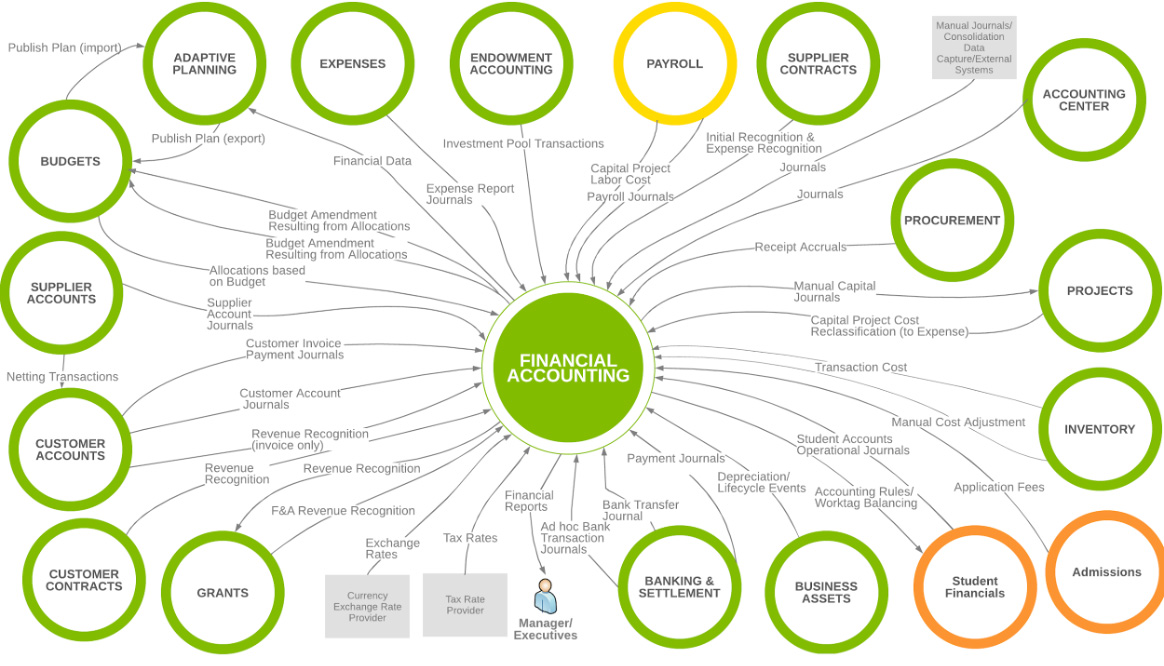

3. Touchpoints Between FINs and Other Modules

Workday’s “power of one” provides organizations with centralized processes and visibility with HR, Payroll, and Financial data at your fingertips.

However, with consolidation of multiple pillars and functions, it is important to recognize the cross-functional implications of financial transactions.

We recommend project teams:

Even within the finance functional areas, communication between teams is critical. Key shared items like Payment Types, Bank Accounts, and Posting Rules should be reviewed by all impacted functional areas, and when designing business processes consider the handoffs between different areas of the business.

By recognizing the touchpoints across the areas of Workday, you can ensure design decisions are being made with all key stakeholders included, preventing unintended downstream impacts and redesign.

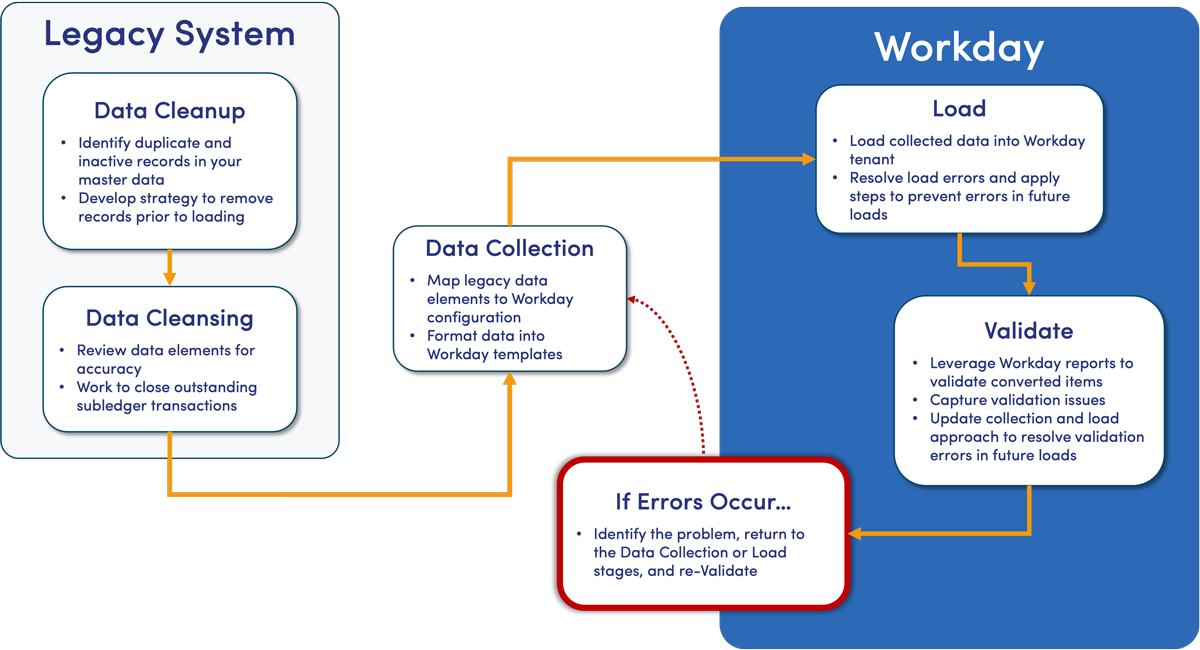

4. Data Conversion

Data Cleanup

Data cleanup should be a proactive endeavor where organizations prioritize scrubbing your data to ensure accuracy and integrity prior to beginning your implementation.

Often data in your current systems has not been recently reviewed for accuracy or contains historical data that is no longer needed or required.

Review data in your legacy systems and identify duplicate and inactive records to remove prior to moving into Workday.

Data Cleansing

Bad data in means bad data out, so it is critical to have clean data to facilitate accurate process flows and reporting in the future state. A Workday implementation is the perfect opportunity to review and cleanse your data to ensure you are only bringing in what is relevant and accurate.

This includes reviewing contact information for suppliers and customers to ensure accuracy, proactively working to collect or write off longstanding open customer invoices, and disposing of fully depreciated assets.

Data Collection – Historic & Future

Align your IT and Accounting teams up front to determine data collection parameters, such as only converting suppliers with activity in the last year.

Additionally, ensure there is internal alignment on historical data access once live on Workday. If historical financial reporting is available, the time span and level of detail required for activities like general ledger conversion can be structured to only convert what is needed to support financial reporting going forward.

Having these conversations early and including all critical stakeholders ensures that you are approaching conversion with a defined data strategy that is consistent across all functional areas. You can begin the work of extracting and cleansing your data earlier, and the functional team has the reassurance that the scope of conversion will meet their current and future needs.

Stay the Course

Implementing Workday Financials brings substantial benefits and opportunity for your organization but requires specific planning, proactive data management, and a clear understanding of what Workday will look like on Day 1.

By keeping in mind the end goal, proactively managing data conversion, understanding Workday’s operational model, and facilitating cross-functional communication and awareness, organizations can pave the way for a successful transition to Workday Financials.