New in 2023 R1 – Aggregate Federal Standard Withholding Wages

As a part of the 2023 R1 update, Workday added support for the aggregation of Federal Withholding on non-supplemental wages if a worker has multiple payroll results in one period. This update allows Federal Withholding to calculate as if all the period’s wages were contained within one payroll result.

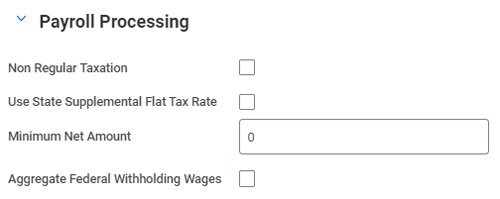

Aggregate Federal Withholding Wages

This new Edit Run Category checkbox allows Workday to calculate the full Federal Withholding tax amount for the period, based on the sum of taxable wages of the previously completed payments for the same period and the in-progress payment for the same period.

Then, Workday subtracts the value of what was already withheld on previously completed payments for the same period. The worker pays the difference between the two values.

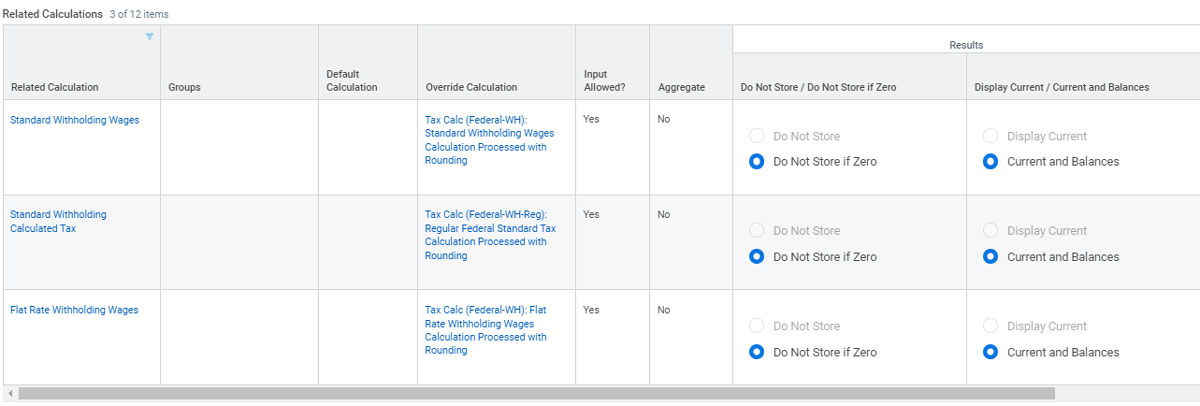

To support this feature, Workday created three new related calculations for the Federal Withholding deduction. Each will calculate in the background if aggregation is enabled. However, these will not display on payroll results when the value equals $0.00.

Additional Considerations

If the feature is not enabled, Workday will not consider wages from previously completed payments for the same period when calculating Federal Withholding.

The checkbox is not effective dated. The aggregation will take place on all applicable payroll results calculated (or re-calculated) after the box is checked.

If expecting aggregation across multiple on-demand payments in the same period along with the regular payroll result, be sure to re-calculate results in between each completion cycle.