Workday comes equipped with many useful reports for Payroll right out of the box. In many cases, Workday provides the exact payroll information you are looking for.

We’ve compiled a list of our go-to reports for Workday Payroll – as well as a few Custom Report definitions (and use cases) you can download below!

Download our Custom Report Definitions for Workday Payroll!

You will receive definitions to all our custom reports via email.

Custom Reports

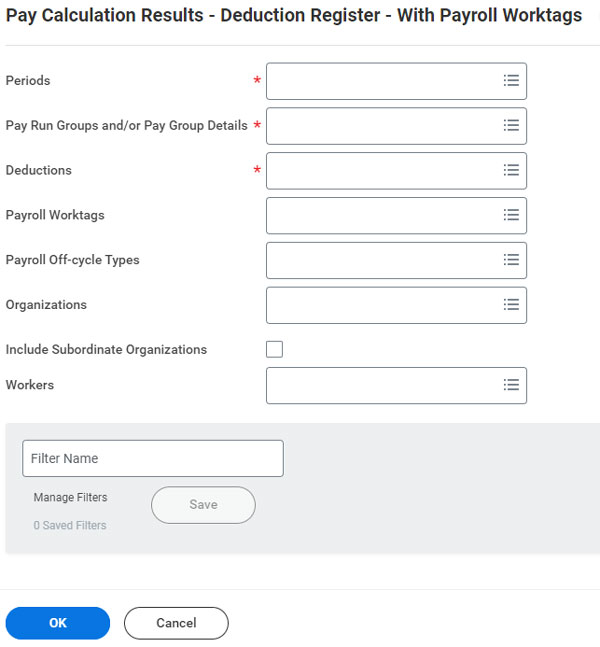

Pay Calculation Results – Deduction Register – with Payroll Worktags

Report Type: Advanced Custom Report

What the Report Does

The report returns all payroll result lines that meet prompt conditions, just like the delivered Pay Calculation Results – Deduction Register standard report.

Periods, Pay Run Groups and/or Pay Group Details, and Deduction(s) are required. Payroll Worktags, Payroll Off-cycle Types, Organizations, and Worker(s) are optional.

Use the Copy Standard Report to Custom report task to copy “Pay Calculation Results – Deduction Register.” Add a column for the Payroll Worktags report field on the Payroll Result Line business object.

Use Cases

Download the Custom Report Definitions

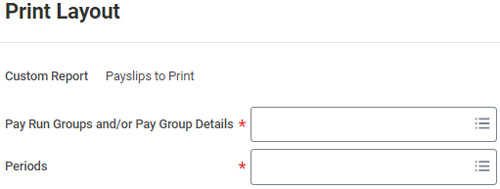

Payslips to Print

Report Type: Advanced Custom Report

What the Report Does

The report allows you to print all payslips that meet prompt and filter conditions. It is a custom copy of the Payslip to Print – Report Design standard report, but requires a business form layout, which can be configured by following the attached instructions.

Use Cases

Note: After configuring the business form layout, you can print the payslips that match the prompt criteria, rather than running the custom report, waiting for the report output to load, and then pressing the Print button at the bottom left of the report’s output.

Download the Custom Report Definitions

Workday-Delivered Reports

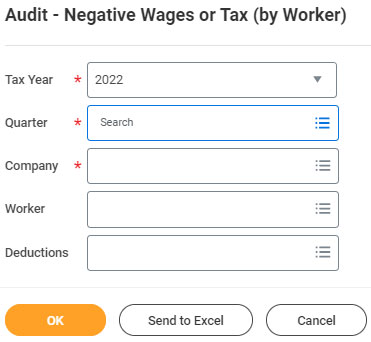

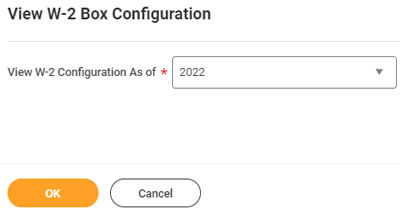

Audit – Negative Wages or Tax (by Worker)

Report Type: Workday-Delivered

What the Report Does

This report calculates whether a statutory deduction and/or at least one of its related calculations has a negative value for the prompted tax year/quarter/company combination. Optionally, you can additionally prompt for specific workers or statutory deductions.

Use Cases

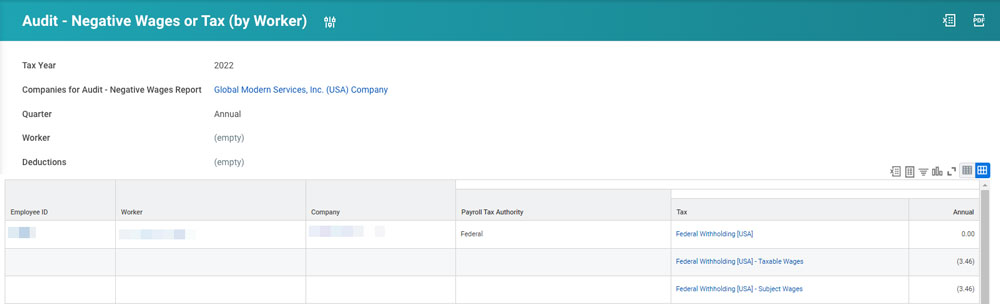

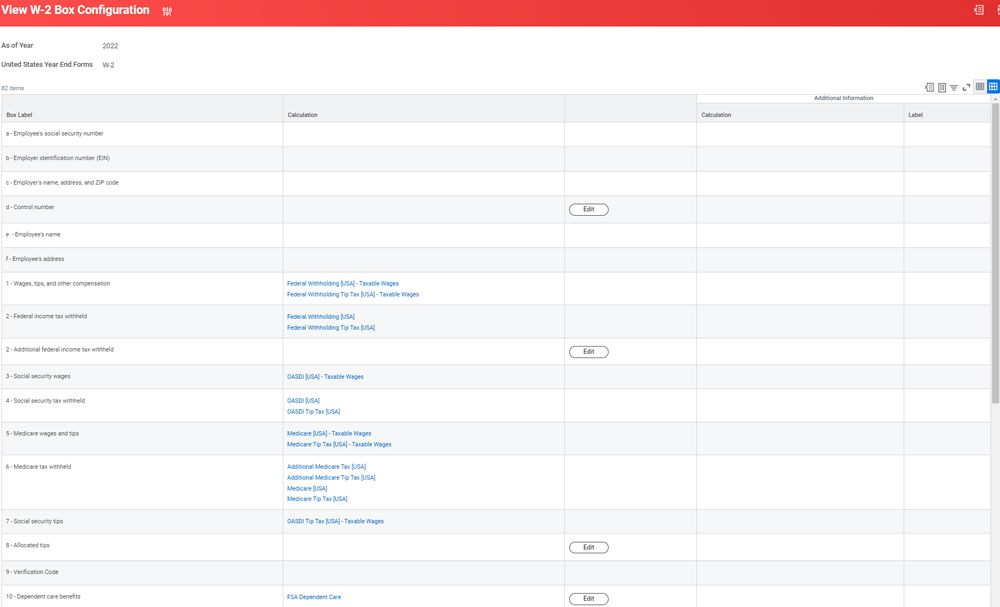

View W-2 Box Configuration

Report Type: Workday-Delivered

What the Report Does

This report allows you to view and modify the payroll calculations (earnings, deductions, pay accumulations, pay component groups, and pay component related calculations) that are mapped to each W-2 box for each tax year.

Use Cases

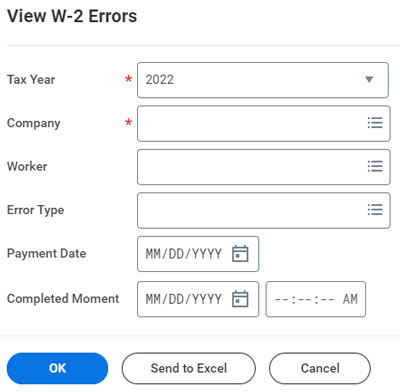

View W-2 Errors

Report Type: Workday-Delivered

What the Report Does

This report runs validations on W-2 Box totals for the prompted tax year and company/ies. Optionally, you can additionally prompt for specific workers, specific error types, up to a certain payment date in the tax year, and/or payroll results completed at or before a specific time.

Use Cases

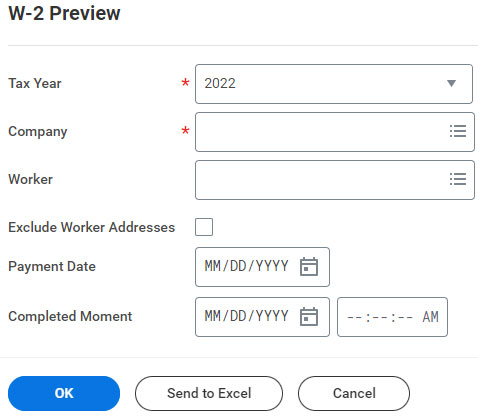

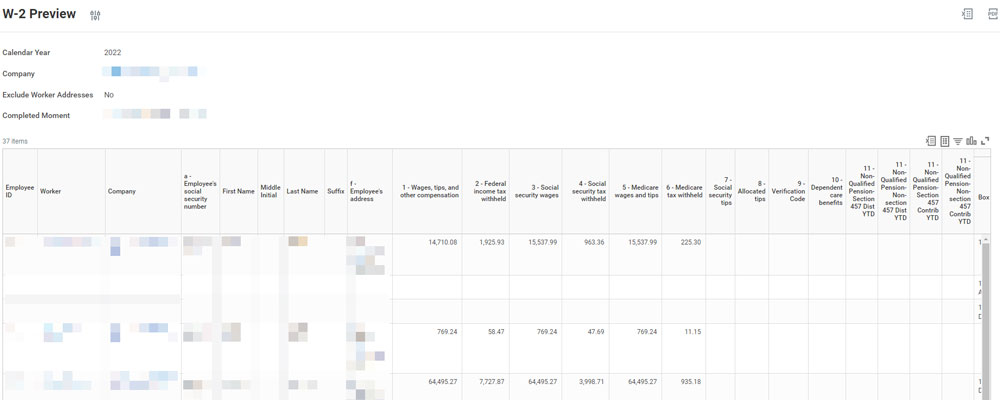

W-2 Preview

Report Type: Workday-Delivered

What the Report Does

This report summarizes W-2 Box totals based on your tenant’s current W-2 Box Configuration, for the prompted tax year and company/ies. Optionally, you can additionally prompt for specific workers, up to a certain payment date in the tax year, and/or up to payroll results completed at or before a specific time.

Use Cases

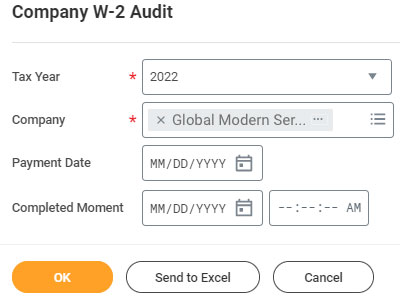

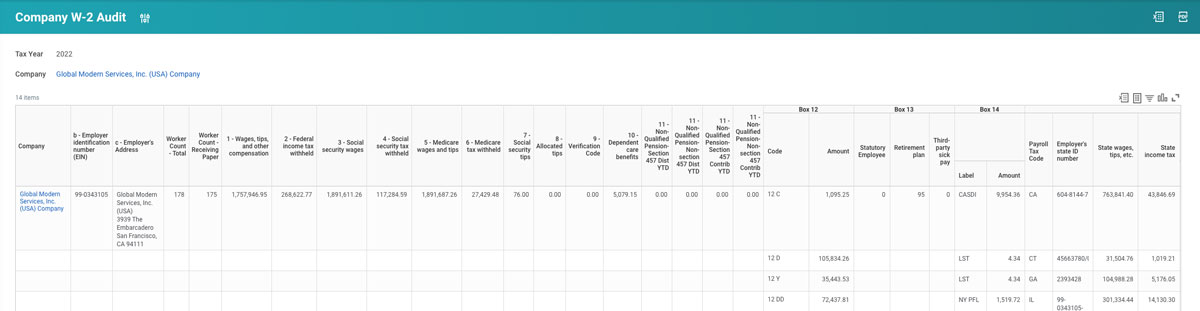

Company W-2 Audit

Report Type: Workday-Delivered

What the Report Does

The reports aggregates data following the format and logic of W-2 Preview, albeit for totals for all completed payments associated with a company.

Use Cases

Net Pay Validation and Arrears Rules (filter by priority)

Report Type: Workday-Delivered

What the Report Does

The reports summarizes whether partial deductions are allowed, whether arrears are tracked and/or recouped, and what the recoup arrears rules are. The report optionally filters on deductions with or without a priority assigned.

Use Cases

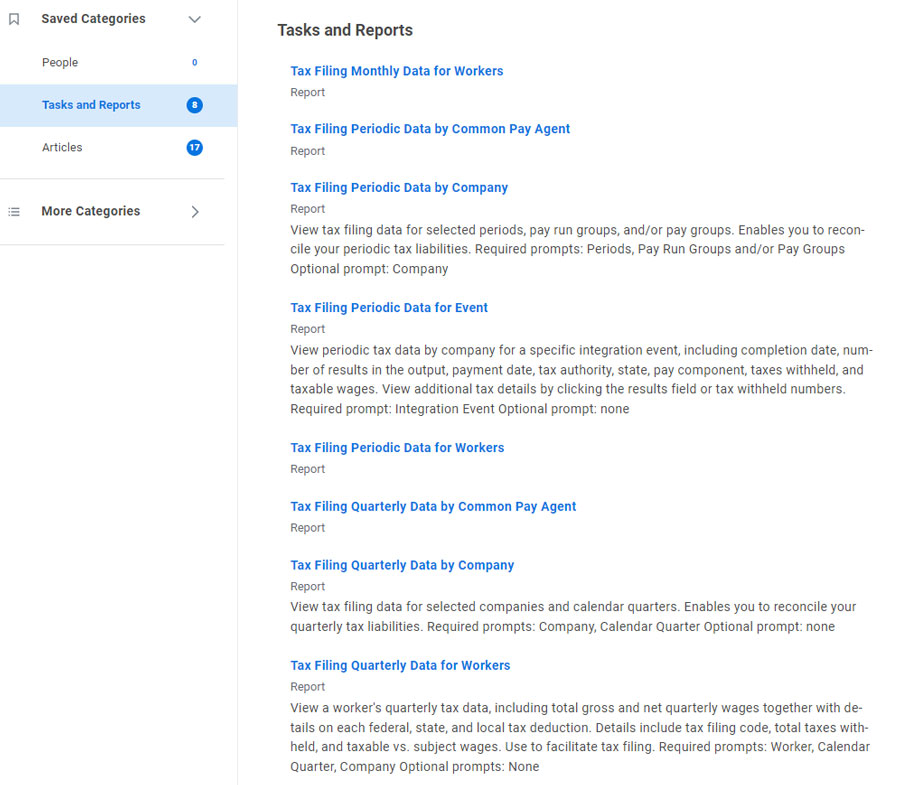

Tax Filing Periodic/Monthly/Quarterly Data by/for Company/Workers

Report Type: Workday-Delivered

What the Report Does

These reports summarize payroll taxes and their wages related calculations by authority, prompted periods/payment date ranges, and other prompts.

Use Cases