Workday Expenses Overview

Workday Expenses is a tool designed to help companies manage and control expenses for a variety of payees, including employees, candidates, students, and contingent workers. It allows for the configuration of payment elections, expense rate tables, and expense items, and supports the management of expense reports, credit cards, travel booking records, and cash advances.

The system centralizes tasks for self-service users, speeding up expense reporting and reimbursement while eliminating paper processes and improving accuracy using machine learning. It also integrates with other Workday products like Human Capital Management (HCM) and Core Financials to streamline expense management, ensuring compliance with regulatory and company-specific expense policies.

Features include:

- automatic calculations

- customizable spending limits

- tools for auditing, budgeting, and reporting on expenses

Workday Expenses helps organizations control spending, process credit card transactions, and analyze expenses across various departments, making it a comprehensive solution for efficient financial management.

Key Workday Expenses Features

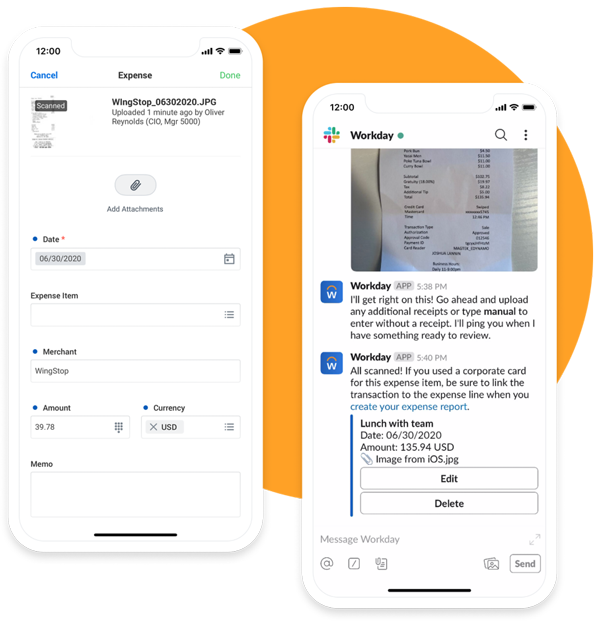

Receipt Scanning

Automatically populates details such as amount, currency, date, and merchant when users scan receipts for quick expenses. Available in all locales, this feature improves efficiency and helps prevent manual errors when submitting expenses through Workday on Android, iPad, and iPhone.

Expenses can be uploaded directly from the Workday App or via integrations with 3rd party platforms such as Slack or Teams.

When a receipt is uploaded to our system, the attachment is sent to our OCR third-party processor, Google Cloud Platform (GCP). The Google Document AI model scans the receipt and extracts key fields, such as merchant, amount, currency, and date, using their expense parser. These extracted values are then populated into a draft expense report within Workday, where users can override the suggested values if necessary.

For more information on emailing receipts, check out this article.

How to Email Receipts in Workday Expenses

Tax Defaulting

Configure the tax code and tax applicability to automatically populate on items in expense reports. Additionally, you can define a default tax recoverability for tax rates within the tax code.

Workday uses these settings to calculate the tax amount for expense lines. Business processes can be automatically routed to Accountants based on worktag usage where they can then review submitted expense reports to ensure the proper capture and accounting of taxes, especially when taxes have different levels of recoverability. You can also enable the option for expense reports to include tax details improving the automation of the system and ensuring taxes are accurately paid

Expense Rate Tables

Determine the eligibility and reimbursement amounts for expense items on expense reports. They can be used to calculate maximum allowable amounts based on location-specific criteria, define the requirements for mileage and fuel reimbursements, and establish per diem eligibility while specifying any applicable deductions. This ensures that reimbursements are consistent with organizational policies and federal guidelines.

Credit Cards

Workers can create expense reports and include credit card transactions. When they create their own reports, Workday will display all available credit card transactions. You can configure the corporate card billing definition to allow workers to manually enter credit card transactions on their reports.

Accounting will automatically be generated from these transactions when loaded into Workday, and when Expense Reports are approved and then paid. These events will use the Spend and Credit Card Payable Account Posting Rules to automatically post entries based on worktag usage.

Spend Authorizations

Spend authorizations are expense transactions that payees use to request pre-approval for estimated expenses.

Payees can enter details such as:

- anticipated spend dates

- Descriptions

- estimated amounts

- spend authorization lines

You can require additional lines for capturing more detailed expense information for auditing purposes, although by default, Workday does not require them unless specifically configured. Additionally, you can configure expense item attributes to ensure payees provide more detailed information and set up rate table-based expense items to calculate totals for committed spend.

To prevent overspending and manage spend authorization amounts, budget checks can be configured to control and monitor transaction budgets, preventing overbudget transactions. Commitment accounting can also track authorization commitments, ensuring control over spend from the original transaction to the spend authorization, with the ability to create commitments in their respective ledgers for better financial oversight.

Key Business Processes

In Workday Expenses, there are four key configurable business processes: Expense Reports, Expense Report Intercompany Events, Spend Authorizations, and Spend Authorization Mass Close Events. These processes facilitate entry, review, and approval of pre-travel authorizations and expense reports.

Business Process Name |

Description |

|---|---|

|

Expense Report Event |

Customize the Expense Report Event business process by incorporating actions as workflow steps to assist in auditing and approving expense reports. This also helps ensure that the reports align with your organization’s travel and expense policies. |

|

Expense Report Intercompany Event |

Adding the Initiate Expense Report Intercompany Event action step to the Expense Report Event business process allows you to hold the affiliate company responsible for the worker’s spend on the expense lines and itemizations. It also triggers the approval process for the company on those lines or itemizations, alerting them to the expenditure. |

|

Spend Authorization |

To configure this, set up the Spend Authorization business process, where you can add various approval steps based on condition rules. Additionally, you can include the ‘Propose Reimbursable Allowance Plan Assignment’ action step to propose an allowance plan for employees requesting spend authorizations. Optionally, you can configure the ‘Check Budget’ or ‘Review Spend Authorization’ action steps as part of the process. |

|

Spend Authorization Mass Close Event |

You can close unused spend authorizations when they are no longer required for processing activities downstream, like expense reports. |

Integrations

You can use web services to import data for Workday Expenses. Some examples include:

- Credit Card and Credit Card Transaction Inbound

- Travel Booking Records Inbound

- Direct Deposit Outbound for Employee Reimbursement

Integrations allow for importing Credit Card data from providers like AMEX, Mastercard, and VISA, enabling end users to include credit card information in their expense reports.

Common Expense Reports and Dashboards

There are several fantastic Workday-delivered tools to help with your Expense management.

Name |

Description |

|---|---|

|

Expenses Management Dashboard |

Examine key information, including expense item trends, total expenses, and the highest-ranking expense items. It also provides quick access to frequently used tasks and reports, allowing you to effectively analyze and manage expense data for improved oversight. |

|

Expenses Hub |

Easily view and access all expense tasks and reports from a single location. |

|

Expense Audit Work Area |

View expenses based on their reporting and payment categories, and utilize reports and graphs to evaluate and analyze spending trends. |

|

Expense Report Work Area |

View expense reports that require action. You can use this report to review, send back for correction, and approve the reports. |

|

Expenses Exceeding Maximum Amount |

View expense report lines and itemizations that go beyond the maximum specified amount for the expense item, excluding those flagged as personal expenses. |

|

No Expense Report Submitted |

View workers who still have not submitted their expense reports. |

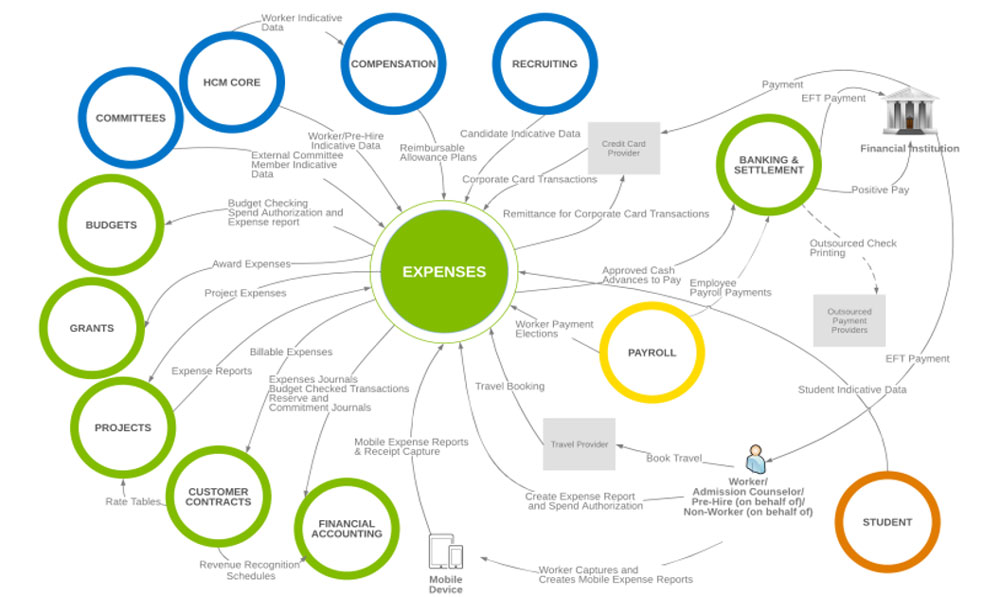

Other Touchpoints to Workday Expenses

In line with the vision of “One Platform,” Expenses has many touchpoints to the rest of Workday Financials and Core HCM.

Business Process Name |

Description |

|---|---|

|

HCM |

Workday Expenses utilizes company and employee data from Workday HCM, such as job profiles, management levels, staffing models, manager assignments, and worker information. It also allows you to create expense reports on behalf of candidates, reimbursing them for expenses related to the interview process. |

|

Payroll |

Payment elections can be configured through self-service to specify the reimbursement method and account for expenses. |

|

Compensation |

You can set up reimbursable allowance plans through advanced compensation and associate them with expense items, enabling employees to submit claims for expenses such as gym memberships and tuition reimbursements. |

|

Projects |

You can use projects and project billing with expenses to enable workers to record expenses for specific projects. Expenses tagged to projects can be included in reporting and billed back to customers when leveraging project billing. |

|

Settlement |

You can either manually settle payee expenses or set up Workday to automatically generate and process settlements for cash advances, credit card transactions, expense reports, intercompany expenses, and spend authorizations. |

|

Financial Accounting |

Approved expense reports generate operational journals that will post directly to your Workday general ledger. Journals can include multiple worktags based on financial reporting requirements. |

|

Budgets |

Budget checks allow you to automatically compare expense transactions with allocated budgets, helping to prevent overspending. This ensures that budgets are adhered to and maintained throughout the fiscal year, promoting better financial control. |

|

Mobile |

By enabling Workday Expenses, workers can easily capture expenses, complete and submit expense reports, and scan receipts to automatically fill in dates and amounts on mobile. This mobile access simplifies the process and improves efficiency for users on the go. |

|

Committees |

In Workday, when you set up committees, you can create expense reports and spend authorizations to reimburse expenses on behalf of nonworkers. |

Interested in a Workday Expense Deployment or Custom Reporting Solutions?

If you are ready to offer a streamlined expense management experience while achieving improved financial and operational visibility, Commit can help.

Our Workday Financials experts can answer any questions you have about Expenses, including implementation support or reporting solutions.

Learn how Commit handles New Module (aka Phase X) deployments.